9-4-2025 – Washington has unveiled punitive tariffs of 104% on Chinese imports, marking a dramatic intensification of Sino-American trade tensions. The measure, which takes effect at midday on 9 April, emerges as a direct consequence of Beijing’s steadfast maintenance of countervailing duties on American exports.

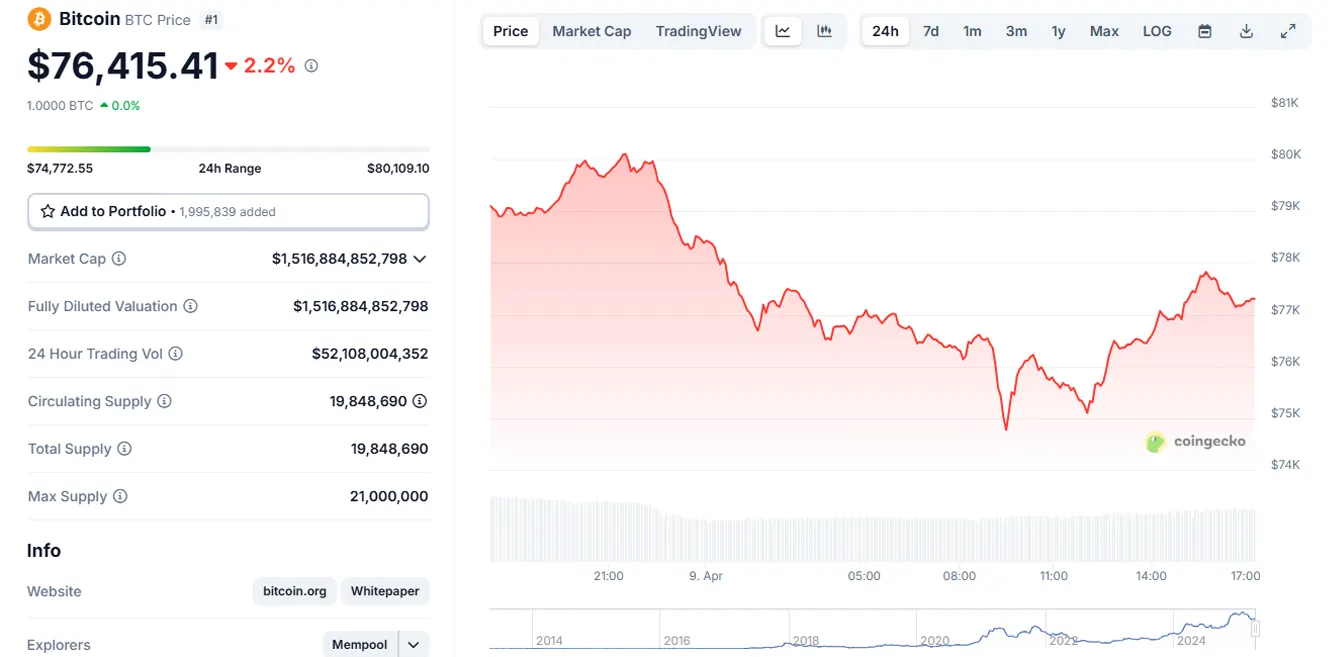

Meanwhile, the cryptocurrency sphere finds itself at a pivotal juncture, with Bitcoin navigating treacherous waters betwixt $75,152 and $77,672. Market analysts remain vigilant as the premier digital asset teeters on this crucial threshold, with mounting speculation about potential trajectories.

Seasoned crypto trader and author Glen Goodman has proffered measured counsel regarding investment strategies amidst the market turbulence. His sage advice emphasises patience over precipitous action, cautioning against the time-worn folly of attempting to “catch a falling knife” during periods of sharp decline.

The digital currency’s path to sustained recovery appears contingent upon breaching the $81,282 threshold, though experts suggest this alone may prove insufficient to herald a definitive trend reversal. A more robust surge beyond $83,792 would likely provide more compelling evidence of renewed bullish momentum.

Whilst Bitcoin’s impressive performance since 2023 has bolstered long-term confidence, recent market gyrations have sparked fresh debate about its growth trajectory. The cryptocurrency’s immediate future remains shrouded in uncertainty, with traders advocating for clear signs of market stabilisation—characterised by consistently higher peaks and troughs—before considering substantial positions.

This nuanced market landscape unfolds against the backdrop of escalating international trade tensions, as the White House’s previously intimated threats materialise into concrete action against Chinese imports, potentially heralding a new chapter in the ongoing commercial rivalry between the world’s two largest economies.