19-4-2025 – The cryptocurrency Ethereum (ETH) finds itself at a pivotal juncture, with market dynamics painting a complex picture of opportunity and caution. Data reveals that ETH’s MVRV Z-Score has slipped below the neutral threshold of 0, entering an accumulation zone reminiscent of late 2020 and 2023. This dip signals that ETH is trading below its intrinsic value, a scenario that historically prompts investors to acquire the asset for long-term holding. Yet, prolonged periods in this zone often reflect wavering confidence among holders or heightened market volatility, leaving Ethereum’s trajectory uncertain.

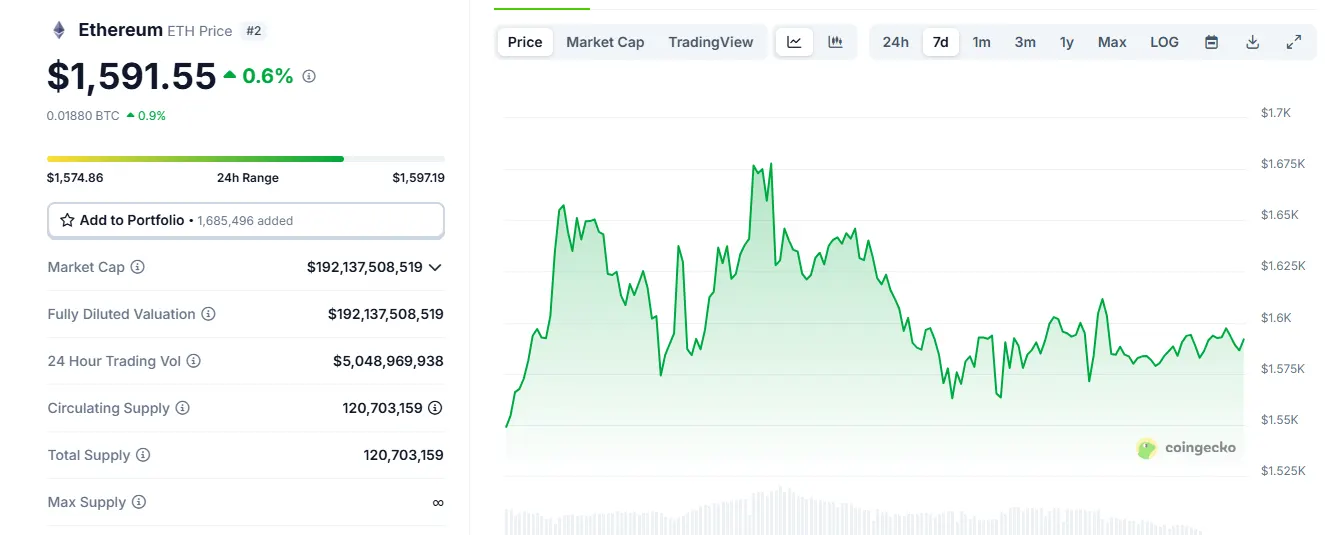

In the first quarter of 2025, ETH endured a bruising 45.3% price drop, plummeting to levels below $2,000—a low not seen since mid-2023. Currently, the price lingers around $1,580, trapped within a narrow trading band between a resistance level of $1,612.59 and a support at $1,566.14. For the past 48 hours, this indecision has held firm, with subdued trading volumes suggesting market participants are bracing for a significant shift. Such tight ranges often foreshadow sharp breakouts or liquidations. A decisive move above $1,620 could ignite bullish momentum, while a breach below $1,566.14 might unleash downward pressure, potentially driving prices towards $1,540 or even $1,500 if selling intensifies.

Compounding the intrigue, whale activity has stirred the market. A long-dormant account, inactive for nearly three years, reawakened to purchase 36,983 ETH for $5.88 million, a move interpreted as a vote of confidence in Ethereum’s medium-term prospects. Significant transfers through the TornadoCash network further hint at strategic accumulation by large investors. However, this optimism is tempered by caution, as Galaxy Digital deposited 12,500 ETH to Binance, part of a broader transfer of 62,181 ETH. Such inflows to exchanges often signal impending sell pressure, particularly in a climate of uncertainty, raising the spectre of a price breakdown if demand falters.

The MVRV Z-Score’s current reading suggests undervaluation, potentially drawing institutional and savvy investors to the market. A climb above 1 could herald a fresh bullish phase, but persistent declines might see ETH revisiting the lows of its previous cycle. The market teeters on a knife-edge, with the interplay of whale movements, trading ranges, and sentiment indicators shaping its next move. Whether Ethereum surges towards recovery or succumbs to further declines hinges on the balance between renewed accumulation and the looming threat of distribution.