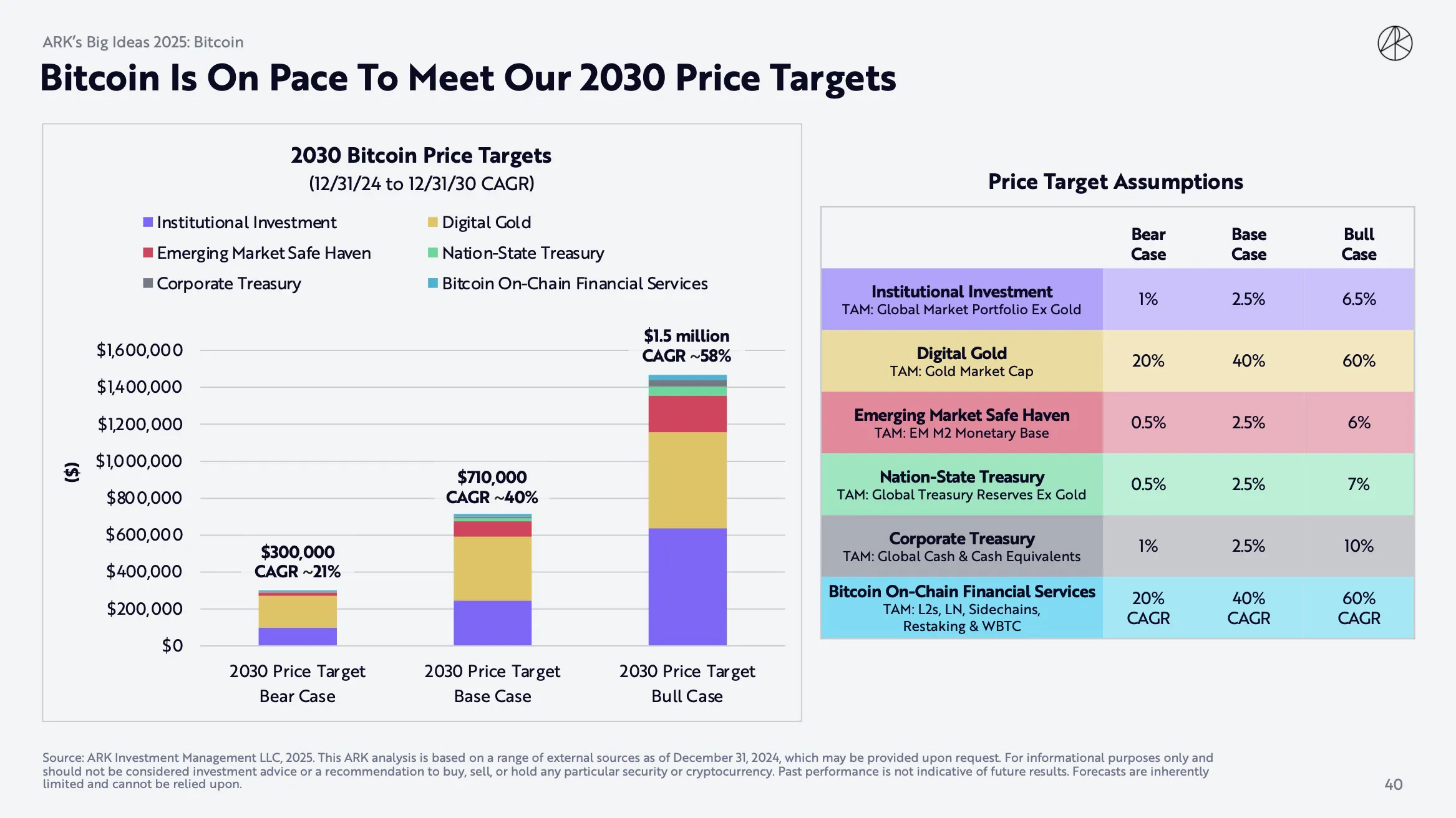

27-4-2025 – In an analysis stemming from their Big Ideas 2025 report, Ark Investment Management has presented an ambitious outlook for Bitcoin’s trajectory towards 2030. The investment firm’s projections span three scenarios, with Bitcoin potentially reaching $300,000 in bearish conditions, whilst bullish forecasts suggest a remarkable $1.5 million per coin.

The landscape of Bitcoin adoption is expected to undergo significant transformation, with institutional investors emerging as pivotal players. These establishments could account for up to 43.4% of Bitcoin’s value in the most optimistic scenario, whilst contributing no less than 32.7% even in conservative estimates.

A noteworthy development in Bitcoin’s evolution has been its recognition at governmental levels. President Donald Trump’s executive order of 6 March, incorporating Bitcoin into US strategic reserves, marks a watershed moment for cryptocurrency legitimacy. This development aligns with the growing trend of corporate adoption, exemplified by Strategy’s integration of Bitcoin into its financial framework.

The analytical framework considers Bitcoin’s role as digital gold, projecting this aspect to represent between 35.5% and 57.8% of its value proposition across different scenarios. By 2030, the cryptocurrency’s circulation is anticipated to reach approximately 20.5 million coins, with Ark’s models suggesting 60% will remain actively traded.

Technological advancement features prominently in Ark’s assessment, particularly regarding second-layer solutions like the Lightning Network and wrapped Bitcoin (WBTC). These innovations are positioned as crucial drivers for Bitcoin’s financial service capabilities and broader market penetration.

Various capital sources are expected to fuel Bitcoin’s growth, including emerging market participants, national treasuries, and corporate cash managers. However, Ark maintains a measured stance, acknowledging that these projections hinge upon meeting specific market penetration rates and total addressable market expectations.