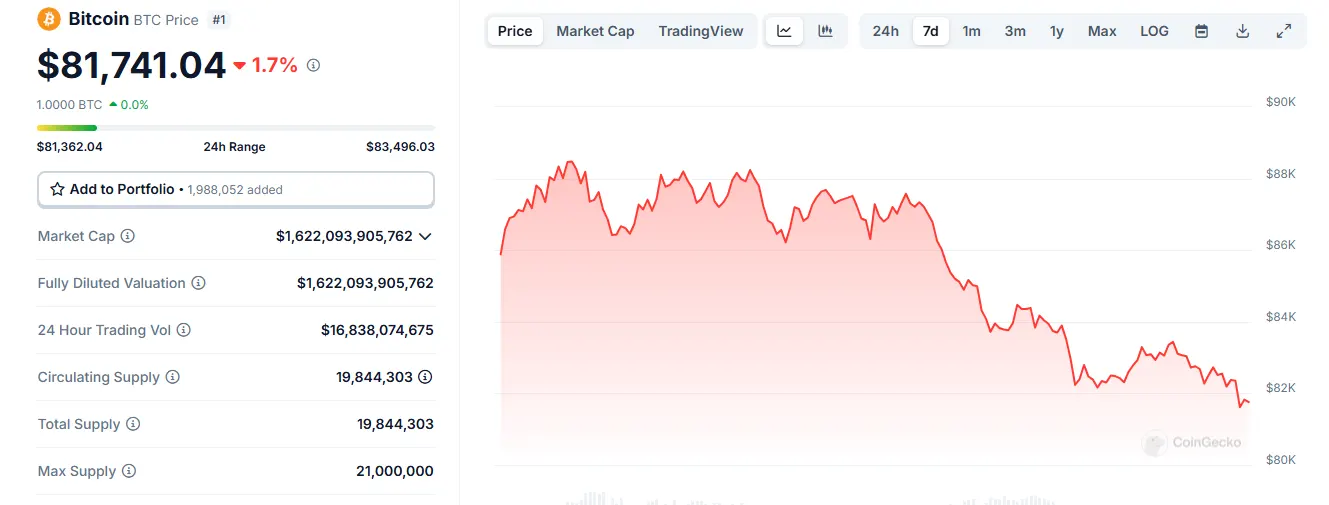

31-3-2025 – Bitcoin witnessed a substantial decline, plummeting beneath the $82,000 threshold during weekend trading, marking a stark reversal from its near-$90,000 peak earlier in the week.

The broader digital assets market exhibited considerable volatility, with Ethereum experiencing a particularly challenging period. The second-largest cryptocurrency by market capitalisation retreated below $1,800, having briefly surpassed $2,000 in recent days, representing a 9% depreciation.

Market sentiment has shifted notably bearish, as reflected in the Crypto Fear and Greed Index, whilst the global cryptocurrency market valuation settled at $2.84 trillion following a marginal 0.24% contraction over 24 hours.

CryptoQuant, a prominent blockchain analytics firm, has observed an intriguing shift in market dynamics. Seasoned traders, who historically capitalised on local price peaks through active selling, have adopted a more conservative stance, favouring accumulation and long-term holding strategies.

The cryptocurrency market’s downturn coincided with broader economic uncertainties, particularly surrounding former President Trump’s anticipated “Liberation Day” and proposed reciprocal tariffs. These developments have cast a shadow over traditional financial markets, with major indices displaying pronounced weakness.

Bitcoin’s market dominance has reached a remarkable four-year zenith of 61.2%, suggesting a significant capital rotation from alternative cryptocurrencies toward the pioneer digital asset. However, declining Open Interest figures, coupled with an increasing proportion of short positions, indicate waning speculative enthusiasm.

Technical analysts, including the respected trader Rekt Capital, have highlighted the significance of CME gap formations between $82,700 and $84,000, potentially establishing crucial support and resistance levels for future price action.

The first quarter’s performance has been particularly challenging for major cryptocurrencies, with Bitcoin recording its most severe quarterly decline since 2018. Similarly, Ethereum’s quarterly performance echoes its 2018 struggles, having depreciated by approximately 45%.

Against this backdrop, traditional equity markets displayed notable weakness, with futures contracts tracking major indices trading lower. The Dow Jones Industrial Average futures contracted by 199 points, whilst S&P 500 and Nasdaq 100 futures registered declines of 0.78% and 1.37% respectively.