10-4-2025 – Bitcoin (BTC) soared to an impressive peak of nearly $82,000 in the early hours of Thursday, igniting a wave of gains across the cryptocurrency landscape. This surge followed a dramatic shift in global trade policy, as President Donald Trump reversed his stance on imposing steep tariffs worldwide, a decision that calmed jittery equity markets by Wednesday. Relief rippled through financial circles, setting the stage for the crypto rally.

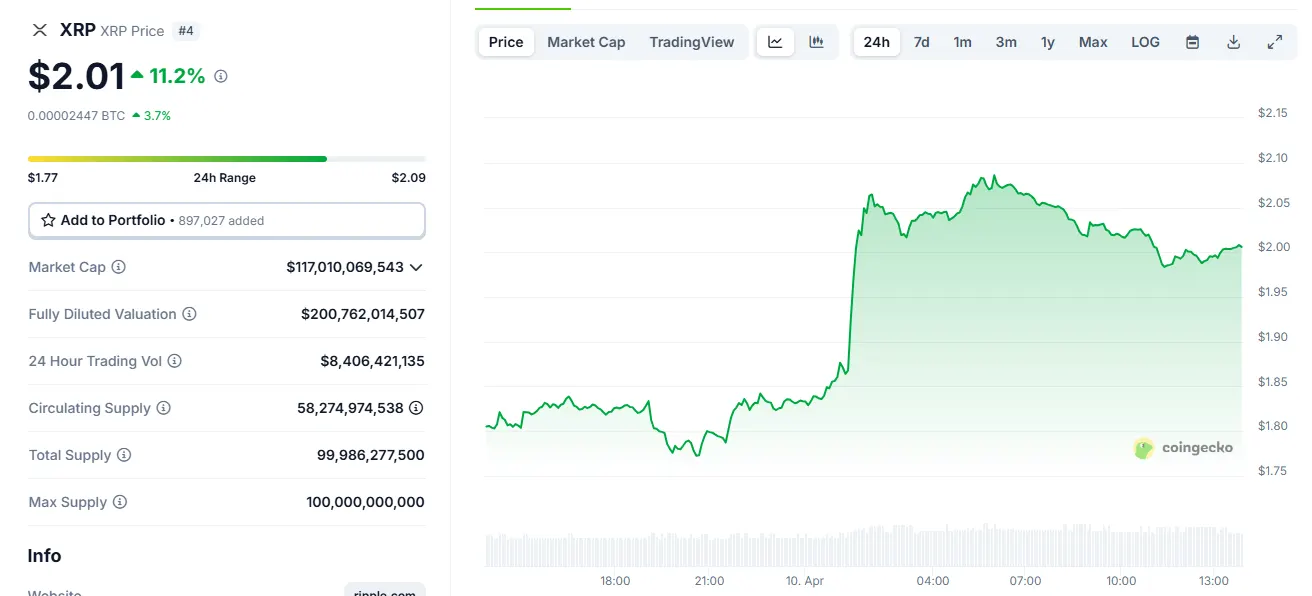

In the realm of major cryptocurrencies, XRP and ether (ETH) stole the spotlight, each leaping by 12%. Not far behind, Cardano’s ADA, BNB Chain’s BNB, Solana’s SOL, and the ever-popular dogecoin (DOGE) galloped ahead with gains of up to 10%. The total market capitalisation swelled by 6%. Meanwhile, midcap tokens—those with market caps below $5 billion—shone brightly, with Bittensor’s TAO, Sonic’s S, and Flare’s FLARE rocketing as much as 30%.

The catalyst for Thursday’s upswing stemmed from Trump’s decision to halt higher tariffs on most nations, sparing them from steep levies that had taken effect the previous day. Instead, these countries reverted to a modest 10% baseline rate. China, however, faced a sharply increased tariff of 125%, a move that underscored ongoing tensions. Global leaders had voiced mounting alarm over recession risks, and this partial reprieve offered a glimmer of stability. On the same day, US stock markets erupted in celebration, with the S&P 500 Index soaring 9.5%—its strongest performance since 2008—while the Nasdaq 100, laden with tech giants, vaulted 12%.

Crypto futures tied to these assets reflected the turbulence, with short liquidations exceeding $350 million—the highest since early March. This purge helped offset the sting of earlier losses when bitcoin had plummeted to nearly $75,000 between Monday and Tuesday. Analysts suggest such liquidations often pave the way for bargain-hunting, hinting at a market poised for recovery after an overextended dip.

Industry voices weighed in with cautious optimism. Jeff Mei, chief operating officer at BTSE, said that the rally reflected hopes of trade negotiations averting an all-out trade war with most US partners. Yet he struck a note of prudence, warning that sustained tariffs on China could reshape global commerce in unpredictable ways. “We’re keeping a close eye on how this unfolds over the coming months,” he remarked. Jupiter Zheng, a partner at HashKey Capital, echoed this sentiment in an email, suggesting the market might have hit a tentative low. “The optimism stems from a sense that the worst could be over, though risks like China’s retaliatory tariffs linger. Still, talks with other nations offer a sliver of light,” he noted.

Zheng also pointed to a broader horizon, suggesting that as US regulators ease crypto restrictions and adopt friendlier policies, digital assets like bitcoin might have found their footing—barring any unforeseen shocks. “The market may not yet fully grasp these shifts, which could mean more room to climb,” he added.