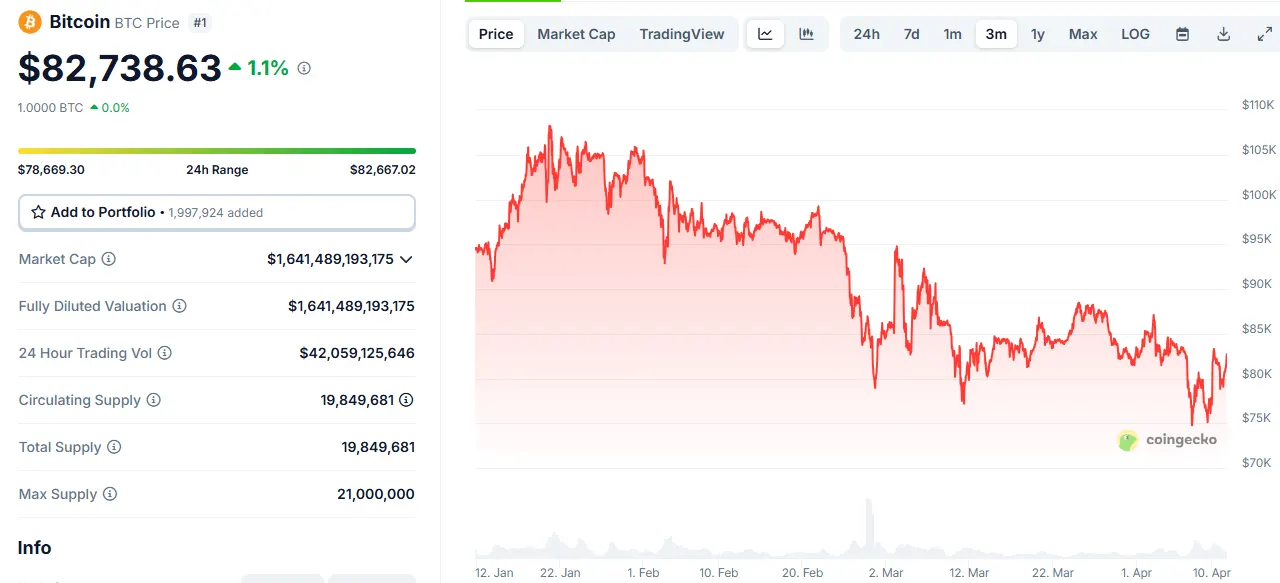

11-4-2025 – Bitcoin’s battle to anchor itself above the pivotal $83,000 mark has faltered, stirring unease among investors wary of a deeper slide amid swirling global economic strains and renewed friction in U.S.-China trade relations. The cryptocurrency, often viewed as a barometer of risk appetite, finds itself at a crossroads, with market watchers scrutinising its ability to cling to the psychologically vital $80,000 threshold.

A fleeting surge earlier this week, sparked by U.S. President Donald Trump’s announcement on April 9 of a 90-day reprieve on global tariffs, propelled Bitcoin to a high of $83,565, up 7% from its recent nadir of $74,300. The pause, which imposed a modest 10% levy on most nations but a stinging 125% tariff on Chinese goods, briefly calmed fears of an imminent trade war. Yet, China’s swift countermeasure—an 84% duty on American imports—has cast a shadow over the initial optimism. Analysts at QCP Capital cautioned that this fragile rally risks unravelling into a deceptive bull trap should retaliatory measures escalate, leaving Bitcoin exposed to a sharp reversal if tensions reignite.

The broader economic landscape offers little respite. Bitcoin’s growing alignment with technology stocks renders it acutely sensitive to monetary policy shifts and inflationary pressures. Earlier this year, the cryptocurrency shed nearly a tenth of its value as tariff threats loomed large. With the U.S. Federal Reserve’s next moves under intense scrutiny, the CME FedWatch Tool suggests an 81.5% likelihood of steady interest rates at the May 7 meeting—a scenario that provides scant relief for Bitcoin’s near-term prospects. The upcoming U.S. CPI data, due on April 10, looms large, as markets yearn for a tame inflation reading to counterbalance the tariff-induced price pressures.

From a technical perspective, Bitcoin’s path is fraught with critical markers. Analysts highlight a cluster of support levels that could dictate its trajectory: the 365-day moving average near $76,000 stands as a bulwark against further declines, with the realized price of $71,000 and the true market mean at $65,000 forming deeper lines of defence. Conversely, resistance looms at the 200-day moving average of $87,000 and the short-term holder cost basis around $93,000. A decisive break above this latter level could rekindle bullish sentiment, but a breach below $76,000 might see Bitcoin spiral towards the lower supports, amplifying fears of a broader retreat.

As Bitcoin wavers, the interplay of geopolitical sparring, inflationary currents, and monetary policy uncertainty keeps markets on edge. The tariff truce has offered a momentary lift, but its failure to defuse underlying tensions leaves the cryptocurrency vulnerable to renewed selling pressure. Should it falter at $80,000, a descent towards $65,000–$71,000 remains plausible, according to on-chain data. With volatility almost certain, investors await clarity from trade developments, inflation figures, and the Federal Reserve’s next steps, all of which will shape Bitcoin’s precarious journey in the weeks ahead.