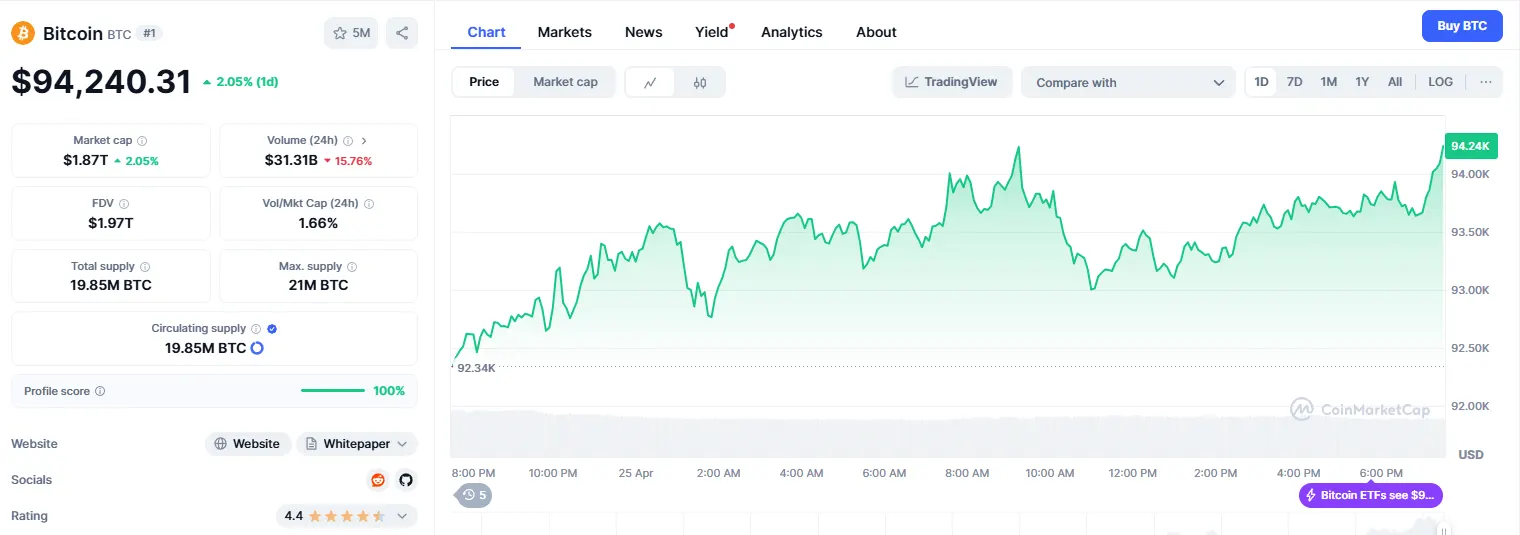

25-4-2025 – Bitcoin has staged a robust recovery, ascending to $94,000 after experiencing a notable dip below $75,000 in early April. Market analysts have identified a fascinating pattern: heavyweight cryptocurrency investors, colloquially known as ‘whales’, are actively amassing substantial positions, lending credence to the sustainability of this upward trajectory.

The movement of digital assets has revealed intriguing insights into investor behaviour, with data from CryptoQuant highlighting an unprecedented exodus of Bitcoin from centralised exchanges—reaching levels not witnessed in 24 months when measured against the 100-day moving average. This exodus of digital assets from exchanges typically signals a robust long-term investment strategy, as investors opt for direct custody of their holdings.

Glassnode’s sophisticated Accumulation Trend Score has emerged as a crucial metric in understanding this market dynamic. This proprietary indicator, which operates on a scale where 1 represents peak accumulation activity, has revealed compelling data: portfolios managing upwards of 10,000 BTC have registered an impressive 0.90, whilst those commanding between 1,000 and 10,000 BTC achieved a notable 0.70. Even modest holdings have shown increasing appetite for accumulation, recording a score of 0.5.

Experts at CryptoQuant have drawn parallels with historical data patterns, suggesting this substantial outflow could herald a significant phase of asset re-accumulation by institutional and private investors alike. This interpretation has been bolstered by Glassnode’s observations on social media platform X, where they confirmed the active participation of major market players in the current rally.