22-4-2025 – Ethereum’s price dynamics are teetering on a knife-edge, with the cryptocurrency grappling to breach a formidable resistance zone around $2,330, a threshold that could shape its near-term fortunes. Binance Market Data reveals that Ethereum is currently trading at $1,647.83, buoyed by a 3.62% uptick over the past 24 hours, as it claws back from a sturdy support at $1,385. Yet, the asset remains ensnared within a descending channel, with repeated recovery efforts thwarted by a dual resistance barrier near $1,703, aligning with the channel’s upper boundary. A decisive break above this level could dismantle the bearish pattern and pave the way for a potential surge towards $2,330, but caution prevails until such a move materialises.

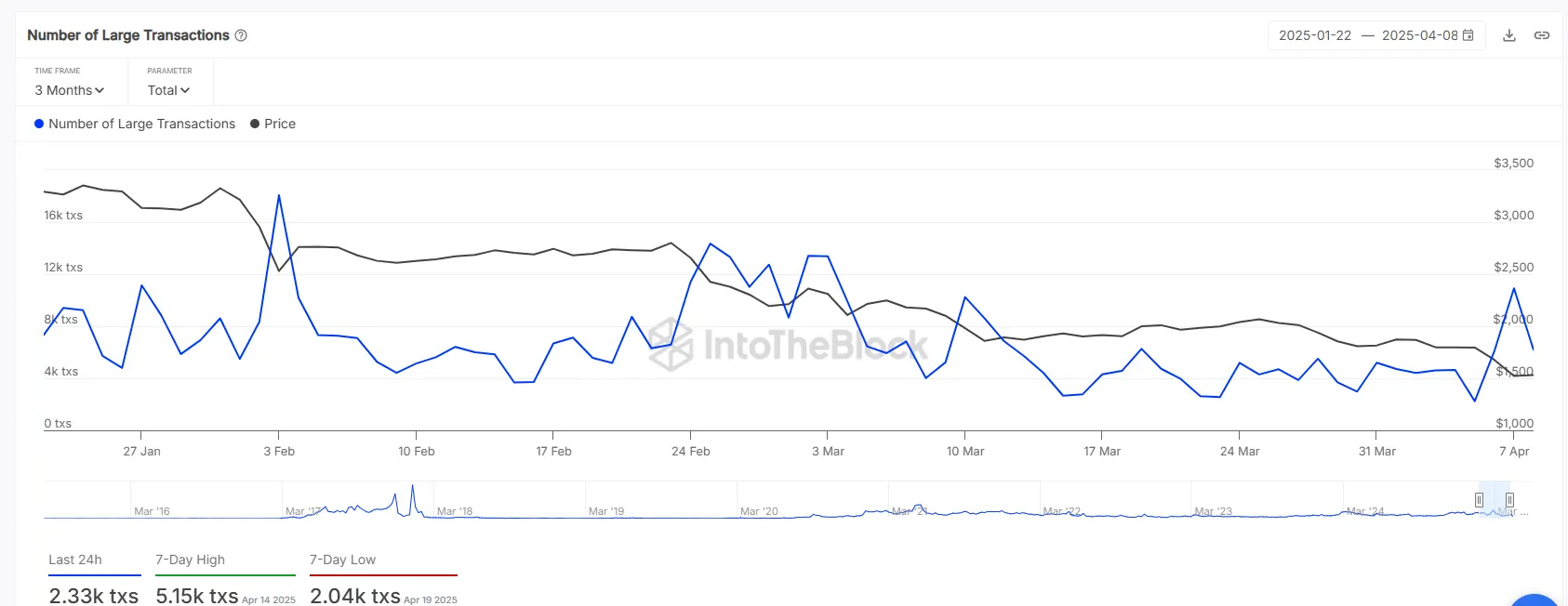

On-chain metrics paint a sobering picture of Ethereum’s ecosystem. Network activity has waned, with total fees plummeting by 56.31% in the past week and a staggering 88.89% over the last three months, signalling a marked decline in demand and usage. Whale activity, too, has retreated, with netflows dropping 49.74% in seven days and a colossal 447.53% over the past month, suggesting institutional hesitancy that dims prospects for a robust rally. While some Ethereum has trickled out of centralised exchanges—evidenced by a weekly outflow of 29,948 ETH, reducing exchange balances by 1.96%—this cautious optimism among retail investors lacks the heft of whale-driven accumulation to fuel significant upward momentum.

A critical supply wall looms large between $2,295 and $2,350, where 2.6 million addresses hold over 6.28 million ETH. This dense cluster forms one of Ethereum’s most formidable resistance zones, likely to trigger selling pressure from holders seeking to break even. Should Ethereum push into this territory, the market could face immediate headwinds, though a sustained breakout above this range might flip resistance into support, rekindling confidence among sidelined investors. For now, however, the market sentiment remains fractured—retail participants display tentative hope, but the absence of institutional conviction and sluggish network engagement tempers expectations.

Despite these challenges, flickers of resilience emerge. Ethereum’s recent rebound from $1,385 to test the $1,650–$1,703 zone hints at latent strength, yet the descending channel continues to dictate price action. Without a surge in on-chain activity or renewed whale interest, any rally risks stalling. The $2,330 barrier, fortified by significant supply and psychological weight, is likely to hold firm unless Ethereum decisively reclaims $1,703 and reignites network demand. As the market watches closely, Ethereum’s path forward hinges on its ability to muster the momentum needed to shatter these constraints, balancing fragile optimism against structural and institutional hurdles.