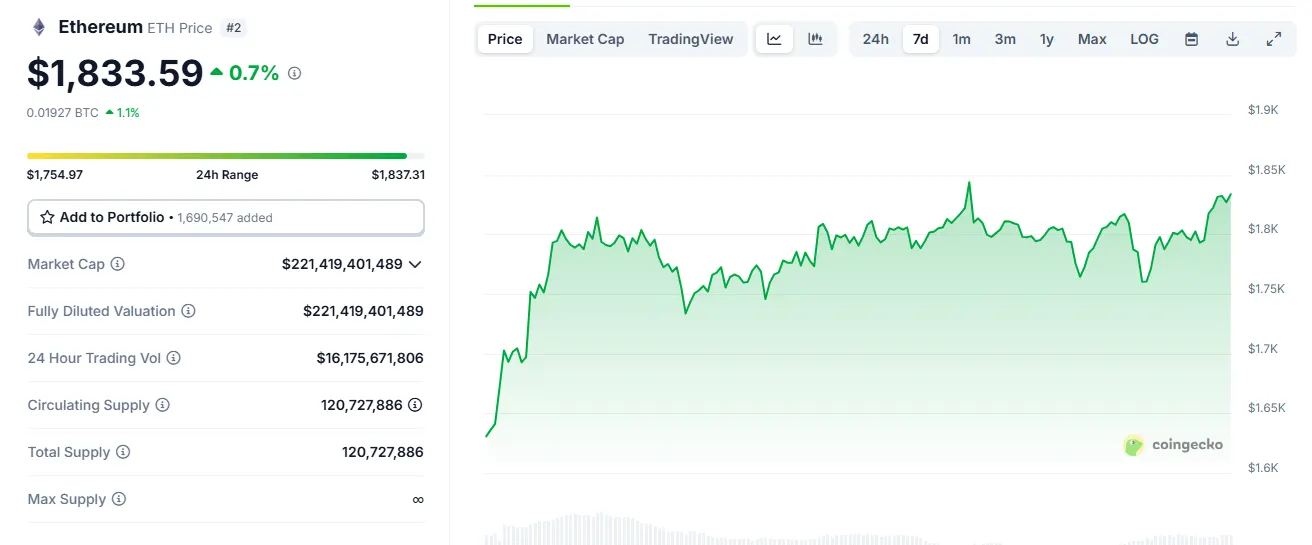

29-4-2025 – Ethereum (ETH) is stirring from its slumber, clawing its way back from a bruising drop below $1,400, yet the cryptocurrency market remains on tenterhooks, wary of mistaking this flicker of optimism for a full-blown resurgence. A potent mix of subtle whale accumulation and nascent technical signals suggests the embers of recovery are glowing, but the path to a decisive rally remains fraught with uncertainty. In this volatile arena, Ethereum is neither vanquished nor victorious—it’s poised at a crossroads, with cautious bulls eyeing the horizon.

The market’s pulse tells a compelling tale. While Ethereum trails Bitcoin (BTC) on the monthly charts, languishing in negative territory against BTC’s robust 13% surge, a closer look at the weekly performance reveals a twist. Here, ETH outshines its rival, racking up gains that double Bitcoin’s, hinting at a quiet capital rotation back into the altcoin giant. This shift gains further credence as Bitcoin nears a formidable resistance zone at $96,000, where upward momentum may stall, potentially funnelling interest back to Ethereum.

On-chain data adds fuel to the speculative fire. Glassnode’s metrics reveal a surge in First Buyers—new wallets snapping up ETH for the first time since February—alongside a reinvigorated cohort of Momentum Buyers, the short-term traders who thrive on rally-driven opportunities. When these forces converge, history suggests a structural reversal could be brewing. Meanwhile, the ETH/BTC daily chart’s Relative Strength Index (RSI) is climbing steadily, shaking off a prolonged spell in oversold territory throughout April, a subtle nod to shifting momentum.

Yet, for all the bullish undertones, caution remains the watchword. The absence of a resolute push from buyers leaves Ethereum vulnerable to capitulation, with the critical $1,900 resistance level looming as both a beacon and a battleground. AMBCrypto’s analysis underscores this delicate balance: while whale accumulation and technical indicators bolster the case for a relief rally towards $1,900, sell-side pressure could clamp down hard, stifling any breakout unless fresh buying power materialises.

The stage is set for a pivotal moment. Volume metrics around the $1,900 mark will likely dictate Ethereum’s next chapter, serving as the crucible where bullish aspirations are either forged or shattered.