10-4-2025 – Ethereum, the titan of altcoins, finds itself battered by relentless selling throughout 2025, with the bears firmly in command of the market’s reins. A wallet rumoured to be tied to World Liberty Financial has offloaded a hefty 5,471 ETH, pocketing $8.01 million at a rate of $1,465 per coin, according to Arkham Intelligence. This disposal, paired with a market price that’s slipped beneath the realized price, sketches a gloomy horizon for the cryptocurrency.

The storm shows no sign of abating. Technical gauges like the Money Flow Index, languishing at a dire 11, scream of extreme selling pressure, with no hint yet of a bullish flicker to counter the plunging price. Ethereum’s value against Bitcoin has also hit rock bottom, a nadir not seen since the twilight of 2019, underscoring the depth of its woes.

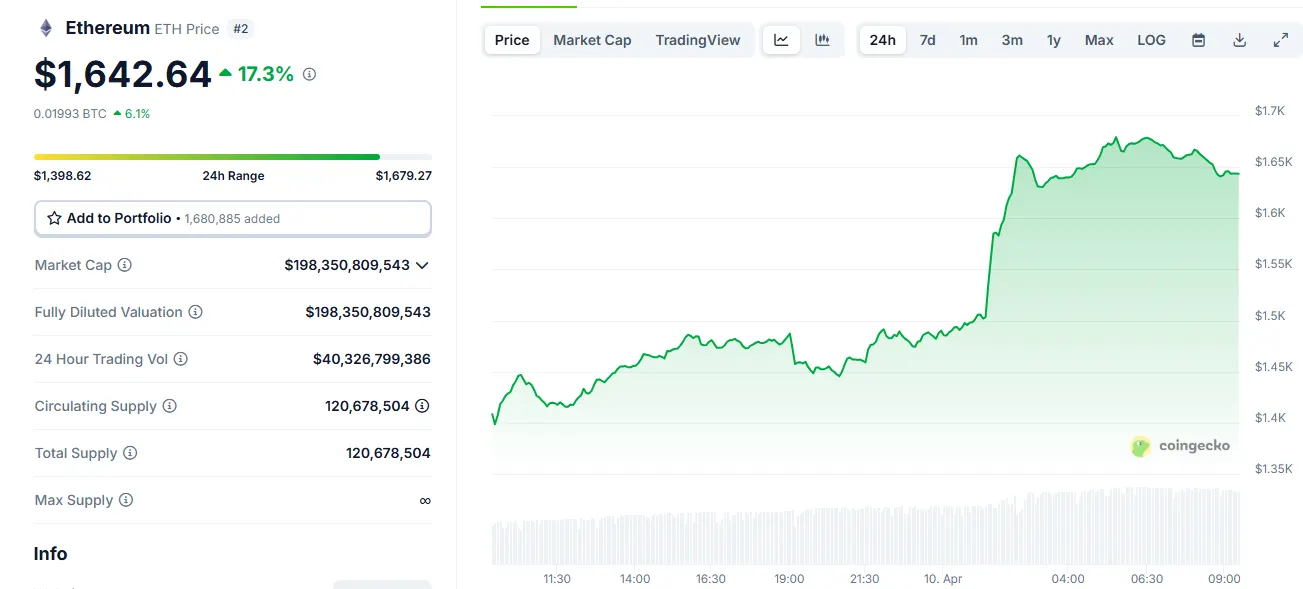

Looking ahead, the charts offer little comfort. A key support line at $1,550—once a bulwark in the autumn of 2023—has crumbled under the bears’ onslaught. Earlier this year, in March, the $1,944 mark, nestled just shy of the psychologically potent $2,000, held firm as a floor. But the past fortnight’s unrelenting sales have flipped it into a ceiling, leaving analysts to pinpoint $1,380 as the next likely landing spot. This level looms large as a juicy liquidity pool, tantalisingly close to today’s price and primed as the bears’ short-term prize.

For those eyeing a bargain, caution is the watchword. A bounce from $1,380 might tempt buyers, but the wiser course is to hold fire—rushing in could prove a costly misstep. Gazing further up the ladder, the three-month liquidation heatmap flags $1,510 and $1,640 as fleeting bullish hopes, with meatier targets at $1,860 and $2,000 shimmering in the distance. Yet even a modest climb to $1,640 feels like a fragile prospect against the bears’ iron grip.

Rewind to November’s rally, and the Fibonacci retracement levels offered a glimmer of structure amid the chaos. The 123.6% extension once bolstered Ethereum’s stand, but that scaffolding has since buckled. Short sellers, meanwhile, might spy a chance to pounce if the price claws back to test $1,550—a level now more foe than friend.

The broader tale is one of enduring gloom. Ethereum’s long-term trajectory remains steeply bearish, and while a slight upward twitch isn’t beyond the realm of possibility, the market’s heavyweights are betting on the bears to keep their crown.