Ethereum’s market pulse, however, tells a tale of resilience amid adversity. As of today, the price stands at $1,523.99, buoyed by a commendable 7.32% rise over the past day. This flicker of upward momentum suggests that, despite prolonged downward pressure, a shift in sentiment may be stirring.

On-chain activity paints a vibrant picture of engagement. On April 9, daily active addresses soared to 573,000, while transactions surged to 1.42 million—a clear signal that enthusiasm for Ethereum’s ecosystem remains undimmed, even at these lower valuations. Such robust participation hints at a growing appetite among users eager to capitalise on the dip.

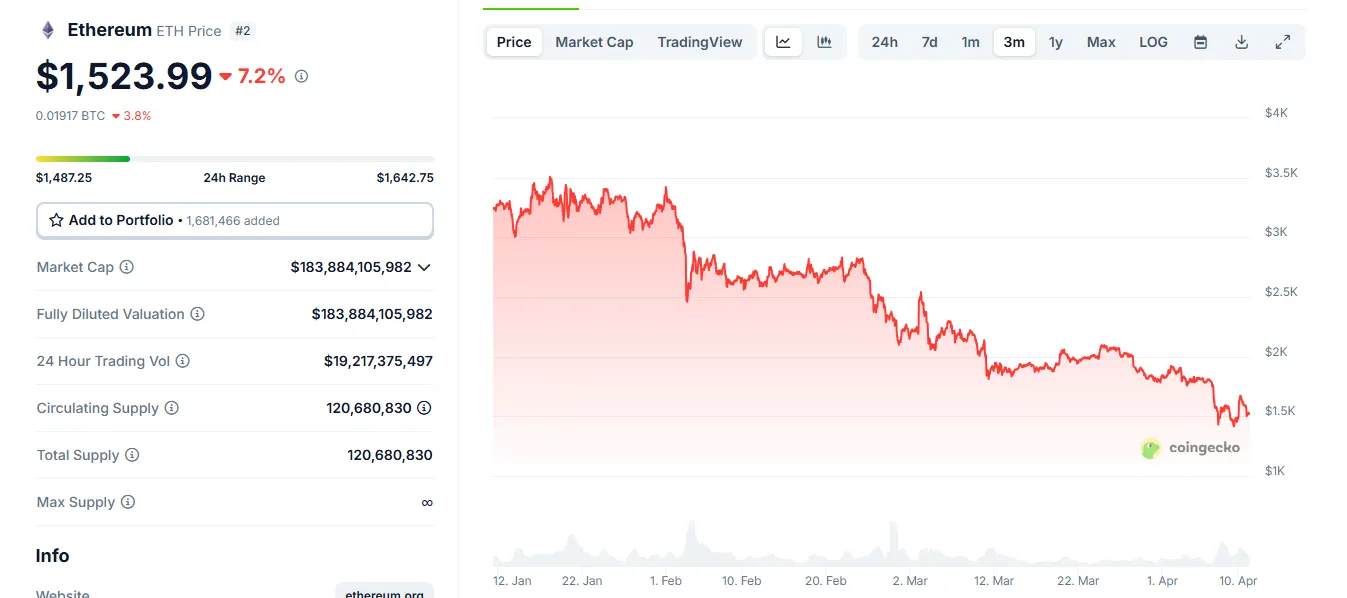

Yet, the price chart remains a battleground. Locked within a punishing descending channel since November 2024, Ethereum has struggled to break free from a pattern of ever-lower peaks and troughs. A recent rally from the $1,460 support has pushed the price towards a formidable barrier at $1,815. Should buyers overpower this resistance, a bullish transformation could unfold, paving the way for an assault on the channel’s upper limits. Failure to do so, however, risks renewed tests of critical support zones below.

Whale activity adds another layer of intrigue. In the past week alone, over 530,000 ETH has shifted across major wallets, a flurry that often signals calculated repositioning or accumulation by the market’s heavyweights. More telling still is the move by a veteran Ethereum holder, who, having acquired their stash in 2016, sold 10,702 ETH—worth $16.86 million—at a modest $1,576. Notably, this seller has a history of exiting only during sharp market downturns, even holding firm when Ethereum soared beyond $4,000. Such calculated moves might reflect a tactical retreat—or a cunning play to unsettle smaller investors, potentially laying the groundwork for a rebound.

The MVRV Long/Short Difference, now languishing at -22.26%, underscores a market stretched to its limits, a level historically tied to moments of peak distress—and prime buying opportunities. Together, these signals—capitulation among long-term holders, frenetic whale manoeuvres, and surging network activity—point to a market teetering on the cusp of reversal.

For astute observers, Ethereum’s current state offers a compelling case. While volatility persists, the convergence of these metrics suggests a rare window for those seeking a foothold before the next upward surge takes hold.