25-4-2025 – Teucrium CEO Sal Gilbertie expressed strong confidence in XRP’s practical applications, positioning it ahead of Bitcoin in terms of real-world utility.

“We believe XRP will have the most utility out there. Bitcoin is a store of value, but I think XRP has a true use case and Ripple will make this work,” Gilbertie remarked, underscoring his firm’s strategic outlook on the digital asset’s functional advantages.

The firm has backed this conviction with action, having recently unveiled a pioneering 2x Long Daily XRP ETF (XXRP). This first-of-its-kind leveraged XRP exchange-traded fund in the American market has demonstrated remarkable traction despite challenging market conditions.

Bloomberg ETF analyst Eric Balchunas noted the product’s impressive performance, amassing $40 million in net assets shortly after launch—a testament to investor interest in XRP’s potential beyond current market sentiment.

Cross-border payment potential drives bullish projections

Standard Chartered’s head of digital assets, Geoff Kendricks, shares this optimistic stance, having forecast a striking 600% surge for XRP to $12.5 within three years. He emphasised XRP’s “unique positioning” for facilitating international transactions, a view that aligns with Ripple’s recent strategic manoeuvres.

The company’s acquisition of prime broker Hidden Road represents a calculated expansion that will incorporate both XRP and Ripple’s stablecoin, RLUSD, into its broader vision for revolutionising global payment systems and trade settlements.

Some analysts consider Kendricks’ projection relatively modest compared to Sistine Research’s bold prediction that XRP could reach between $33-$50 by 2027—potentially representing a staggering 1500%-2500% increase from current levels.

Sistine Research has identified striking similarities between XRP’s current price behaviour and its breakthrough following the 2014-2017 consolidation period. Should this pattern complete its formation, the cryptocurrency could exceed $30 within two years.

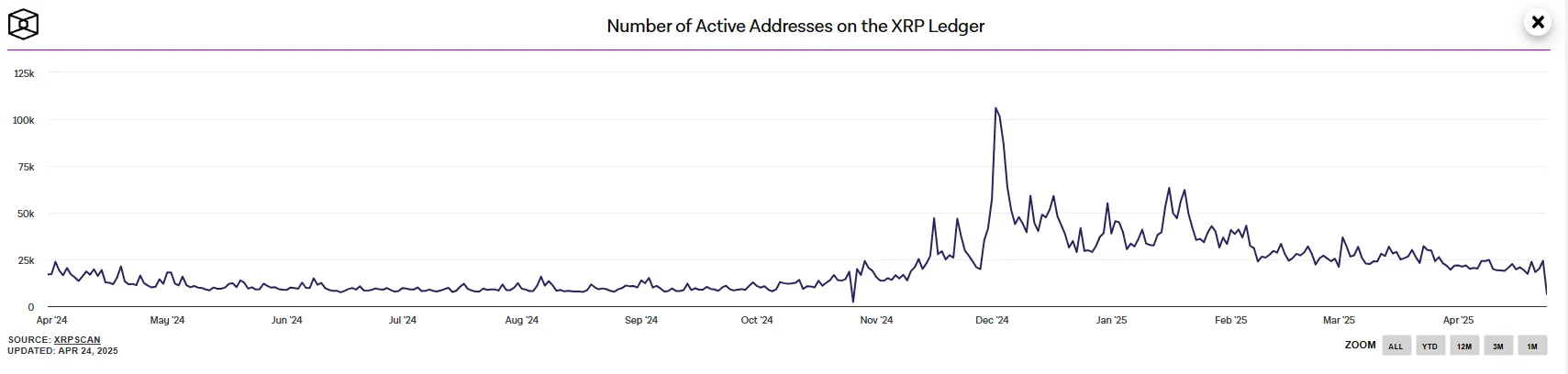

However, broader network metrics present a more nuanced picture. XRP Ledger address activity has shown a concerning slowdown in 2025 and remains below previous levels, suggesting that robust price appreciation may face delays unless network engagement substantially increases.

The cryptocurrency recently touched an April peak of $2.3 before experiencing resistance and retreating to a key support level at $2.1, characterised by analysts as a bearish-bullish order block. Market watchers note that sustained bullish momentum depends on successfully defending this threshold and maintaining a Relative Strength Index above the crucial 50-point mark. Failure to hold these levels could push the price below the psychological $2 barrier once again.