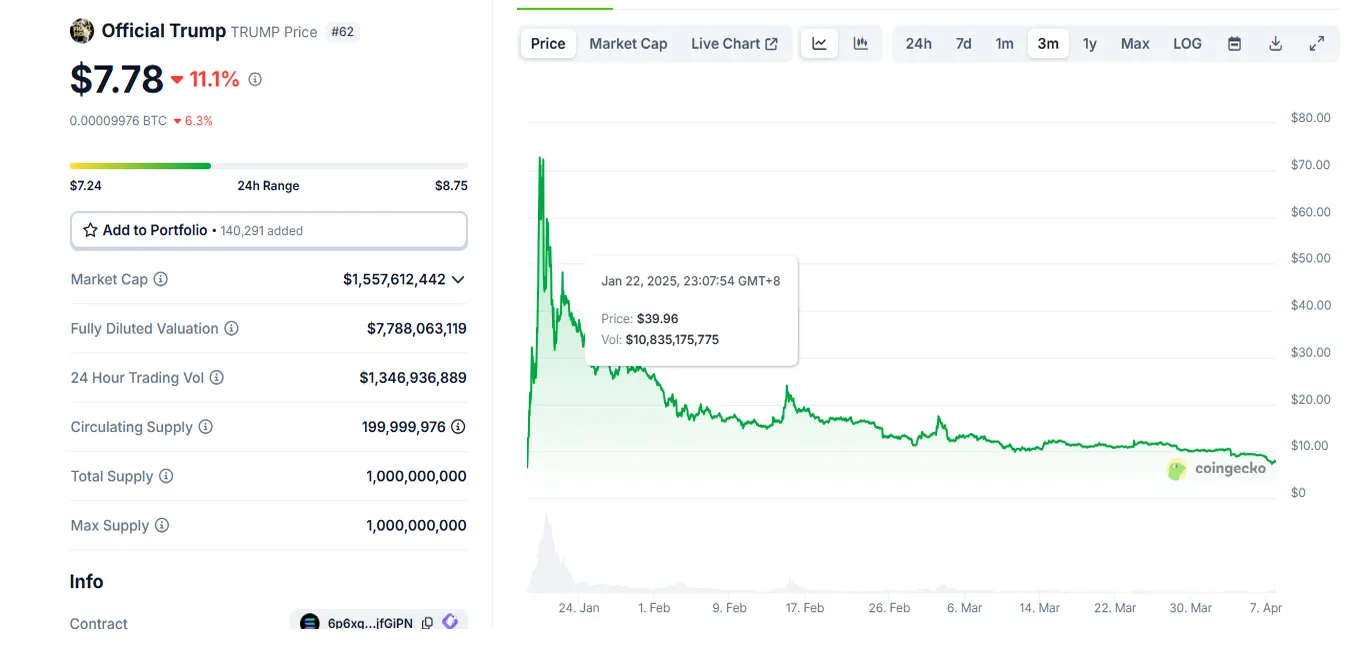

8-4-2025 – The Trump-linked digital token (TRUMP) has experienced a substantial decline, marking a 15% decrease within a single trading day as Bitcoin retreated to $74.5k on Monday. Despite the price erosion, trading activity has surged remarkably, quadrupling in volume over 24 hours. Market analysts suggest this surge in trading volume, coupled with rapid price deterioration, signals a prevailing bearish sentiment.

Technical indicators paint a particularly grim picture, with the On-Balance Volume (OBV) metric breaching crucial support levels that had previously held steady since mid-March. The technical landscape appears especially challenging across multiple timeframes. The Relative Strength Index (RSI) has plunged to 23, indicating severely oversold conditions. However, market watchers identify $7.6 as a potential support level, corresponding to the 23.6% Fibonacci extension.

A deeper analysis of shorter timeframes reveals equally concerning patterns. Whilst the RSI shows early signs of recovery from oversold territory, the prevailing sentiment remains decidedly bearish. Should a brief price recovery materialise, resistance near the $9 mark—a former support level—could prove formidable.

Looking ahead, technical projections suggest the possibility of further decline, with the 61.8% Fibonacci extension level at $4.47 emerging as a key target. This bearish trajectory appears particularly pronounced in the quarterly chart, reflecting a consistent downward trend since the beginning of the year.

The recent market behaviour has effectively erased the modest accumulation witnessed throughout late March, with selling pressure now dominating the trading landscape. Market participants considering new positions might watch for potential short-term price rebounds, which could present strategic exit opportunities.