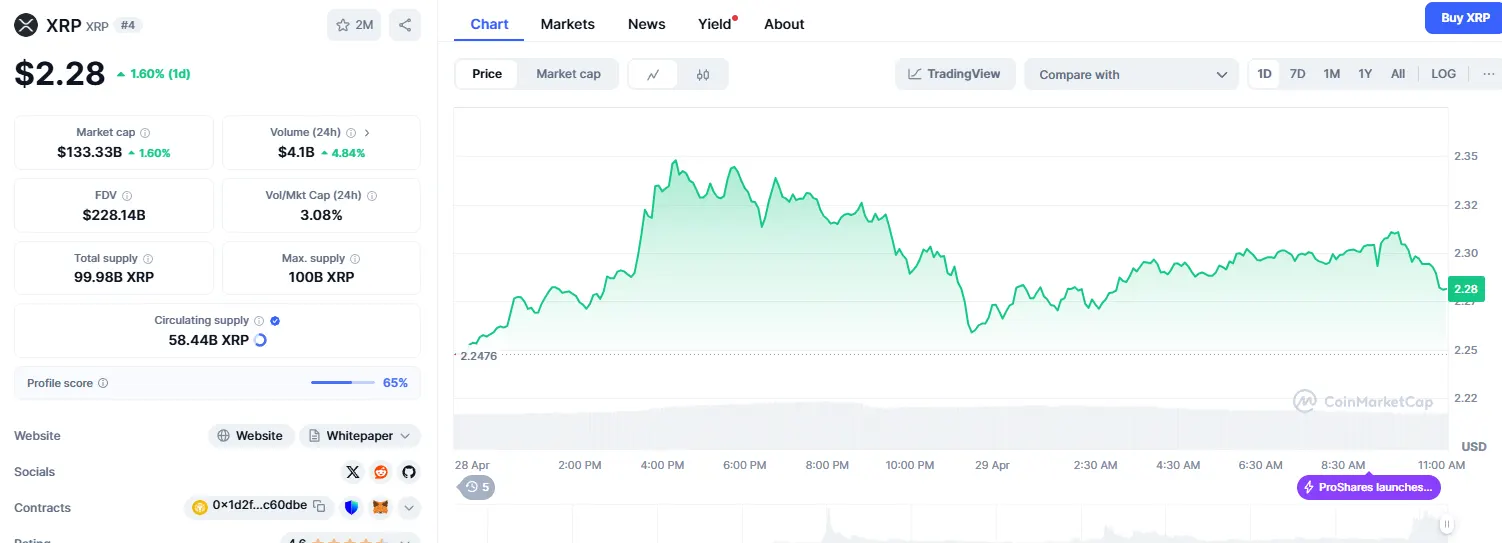

29-4-2025 – Ripple’s XRP has demonstrated remarkable strength, breaching a critical technical threshold with a notable surge to $2.32, marking a robust 6.73% appreciation within a day’s trading.

The digital asset’s technical landscape presents a compelling narrative, having conquered the neckline resistance of an inverse head and shoulders formation – a pattern closely monitored by market technicians for its historically bullish implications.

Yet, market observers have raised eyebrows over a substantial whale movement, as 29.5 million XRP tokens found their way to Coinbase’s coffers. This considerable transfer, valued north of $68.7 million, has sparked discussions regarding potential market implications.

The derivatives arena has witnessed unprecedented activity, with trading volumes soaring by an extraordinary 203.98% to reach $10.71 billion. Perhaps more telling is the stark imbalance in market positioning on Binance Perpetuals, where bullish sentiment dominates with 82.35% of traders maintaining long positions.

On-chain metrics paint an increasingly optimistic picture, with the Network Value to Transactions (NVT) Ratio recording a 15.74% decline – a development typically associated with strengthening network fundamentals. This technical indicator suggests increasing utility across the XRP ecosystem.

The social sphere has begun to buzz with renewed interest, as metrics indicate a steady uptick in engagement. Social Volume registers 363 mentions, whilst Social Dominance has climbed to 3.91%, though these figures remain below historical peaks.

Looking ahead, market participants are closely monitoring the $2.26 support level, viewed as crucial for maintaining upward momentum. Should this foundation hold firm, technical analysts project potential advances toward $2.612 and $2.90.

However, seasoned traders remain mindful of the concentrated long positions, which historically can precipitate sharp market adjustments. The substantial whale transfer to Coinbase adds another layer of complexity to the market dynamics, potentially introducing near-term volatility.